Everyone loves a great comeback story. What better comeback story is there then someone who worked really hard to reach the top just to crumble and fall down fast into an abyss? Then there is hard work, resurrection, redemption, more hard work and, ultimately, success again.

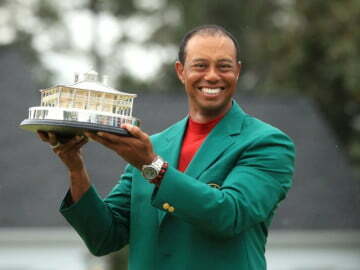

If you haven’t heard Tiger Woods just recently won his 15th Major Championship. He has 5 Masters Tournament wins in total, 1 short of the record accomplished by Jack Nicklaus (aka the Golden Bear). With that victory, he earned his 81st PGA tour win, 1 behind the record of 82 set by Sam Snead.

Tiger also trails Nicklaus in the number of total Major Championship wins by 3. Tiger’s win at the 2019 Masters Tournament is less so a story of his pursuit for the most career Major Championship wins, but rather, a greater story about a man who was at the pinnacle of success, lost it all and then crawled and fought his way back to the top again. Another word, his story can make for a great Greek mythology.

Brief History Of Tiger Woods

Tiger – Hello World

Tiger, almost seemingly, burst onto the scene back in 1997 with his recording breaking win in Augusta to capture his first Masters at the age of 21. He won the US Amateur Championship 3 times before turning pro but I don’t think people could predict that he would go on to win the Masters by a record 12 strokes a year after turning pro.

Tiger then went on to win 11 PGA tournaments since capturing the Masters in 1997 to the end of 1999. He then capped it off with one of the best year in golf ever in 2000 with the Tiger Slam (holding all 4 Major Championship trophies at once) and winning 9 PGA tournaments in total.

He goes on to win more PGA tournaments, capturing 5 Masters, 3 British Open, 3 US Open and 4 PGA Championship. For good measures, he was the winner of 2 Fedex Cups as well. He was at the top of the golf world.

Tiger’s success wasn’t only confined to the golf course. Seemingly, he had a great life outside of golf. He married Elin Nordegren, a former Swedish model, and they have 2 children together. Also, Tiger became the face of multiple billion dollar brands including being the golf ambassador for Nike. His golf winnings along with his endorsement deals made him every rich. Some projected he was worth more than $500 million with some projecting he would be the first pro-athlete to be a billionaire.

Tiger’s Fall

Despite his quick rise in the golf world, it seems his fall came even faster. Tiger Woods fell in the world golf rankings from ending the year in 2013 at number 1 to number 416 in 2015 and ending 2016 at 652. His wife ended up divorcing him and his neatly crafted image destroyed by stories of his infidelities. His sponsors also left him.

Consequently, his finances took a hit. Not only was he not winning golf tournaments with the $1,000,000+ purses, he lost sponsors costing him millions. His divorce settlement also cost him a reported $100 million.

Not to mention he continued to face physical pain. After years of playing golf at a high level, his knees, back and neck were hurting him. He had numerous surgeries to try to cure his ailments. It is hard for a golfer to come back from such physical challenges.

Tiger’s Rise Once Again

There was a 5 year gap from 2013 to 2015 in which Tiger did not card a win in the PGA Tour. In September of 2018, Tiger finally broke through again and notched a victory on the Tour Championship.

Finally comes 2019 when he won the Masters, a record total of 11 years in between Majors. Now, Tiger sits on top of the golf world once again. He has renewed talks of chasing down The Golden Bear’s record of 18 Majors and, in the process, will break Sam Snead’s record of 82 PGA wins.

His story is one that is still being written. No one knows how it will eventually end but there are 9 lessons we can learn from Tiger in his comeback win at the Masters that we can apply to our investing life.

Lesson #1: Success Isn’t Always A Straight-line

As previously mentioned, Tiger was at the top of the golf world at a very young age. Then came the down fall, fast and shift. But he came right back to reach the pinnacle once again in 2019. Success might not always be a straight-line. There can be highs and lows.

The same can be said for investing. Wouldn’t it be great if every investment you made moves continuously higher? Unfortunately, investing doesn’t always work that way. You have to be prepared to ride the highs and lows. Too often, people cannot handle the ups and downs.

Take the Great Recession as an example. Many people invested in the stock market during the run up in 2005 to 2007 were elated with the incredible ride up. They were riding high and the stock market only seemingly went one direction – higher. Then came the great crash in 2008 with the S&P 500 losing about 50% from the highs in late 2007 to the depth in 2009.

Many people couldn’t handle the downturn and ended up selling out of stocks by the end of 2008 and 2009. The S&P 500, after the depth in 2009 generated over a 300% return, reaching an all-time high today. Today, it is about double where the S&P 500 was at the peak in 2007.

Those people who took their money out of the stock market back in 2009 never had the chance to see their investments not only recover, but double in value.

They didn’t understand lesson #1 – in investing, success isn’t always a straight-line. We can recover from the lows.

Lesson #2: It’s Never Too Late To Come Back And Win

Tiger, at age 43, just won his 15th Major. Tiger surely didn’t think he would be too old to win again on tour. Additionally, he maintained a positive attitude which enabled him to come back from his lows to win.

This lesson can apply to our investing life as well. It’s never too late to come back and win. We can still be successful investors even having failed before. We can also be successful investors late in life. After all, Warren Buffet made over 99% of his money after the age of 50.

We shouldn’t be distraught at a late start. We can still be successful in investing.

Lesson #3: Stay Focused And Disciplined

Tiger always approaches his rounds with focus and discipline. He spends a lot of time practicing and repeating the process.

When Tiger was a young kid, his dad would randomly cause distractions for Tiger during swings to teach his son to always remain focused at the task on hand. His level of focus and discipline is very high.

We should also stay focused and disciplined with our investing. Socking away money into a retirement account is a great example of this.

I’ve set myself up to automatically contribute 25% of my salary into my 401(k). Once the money is in my 401(k) account, it gets automatically invested into an S&P 500 mutual fund. I ignore a lot of the noise on cable news about stock market movements. It is my focus and discipline in this process which allowed me to become a 401(k) millionaire in my 30s.

If you have an investment strategy to dollar cost average into a stock by buying more at each 10% drop, then do so (after you have re-assessed the position and still think that it is a sound approach). Do not be distracted by the current news or noise.

Lesson #4: Boost Your Confidence By Having Small Wins

Tiger came back from falling down in the game of golf. Even for a past champion and former #1 player in the world, his confidence can take a hit. Self-doubt starts to creep in. He might even question if he has the ability to win again.

Tiger took small steps in coming back. He came close to winning a few tournaments in 2018 and finally won the Tour Championship in September of 2018. He was competitive in a few tournaments in which he did not have his best game. This provided him with a confidence boost and showed him that he can still be competitive at a high level.

If starting out in investing, you don’t need to take a big leap into an investment. You can start small and see if the investment or investing strategy works for you. Hopefully, those small investments can result in small wins. Those wins can boost your confidence level to take on more exposure in the future.

When I first tipped my toes into real estate investing, I started off with a lower priced property. I wanted to gain experience with being a landlord first and didn’t want to put a lot of my money at risk.

The initial rental property purchase allowed me to learn and to be educated on how to manage a rental property. It provided me confidence to then move ahead and take down bigger and bigger deals. I didn’t jump into real estate investments buying 5 rental properties all at once. Because of my positive experience in running the first rental property, I decided real estate investment should be a cornerstone of my investment portfolio.

Lesson #5: Be Patient And Let The Game Come To You

Tiger was patient with his game and he didn’t try to do too much to force the issue. That was his strategy going into the Masters. Obviously, this strategy worked out well for him.

Being patient is also an important virtue in investing. In certain situation, there is no need to take incremental risk to force a higher return. I’ve invested in the S&P 500 since my first paycheck. I was disciplined in my approach on this. I have done well with the S&P 500 over the past 20 years.

However, about 10 years ago I started to get impatient with this approach. Investing in the S&P 500 was a long term play and I wanted to hit homeruns in a shorter period of time. I decided to invest in options.

On my second option trade, I bought a put option on a stock I thought would fall. The stock went up instead because of a surprising announcement from a competitor leaving the market of this company. My put option ended up expiring without being exercised. I lost my entire investment of $35,000.

It was also the last time I’ve invested in options.

Lesson #6: Understand Where You Are On The Scoreboard And Act Accordingly

Tiger was up by 2 strokes heading into the final hole of the Masters. Tiger understood that he can boogie the last hole and still win the tournament. He didn’t need to take undue risk with that hole.

Tiger did not use a driver on the tee. He hit a safe approach shot onto the green. He ended up carding a 5 on a par 4 hole but that didn’t matter for him. He still won the tournament by 1 stroke.

Tiger understood where he stood on the scoreboard prior to beginning the hole and knew what he needed to get in order to leave a winner.

This is important in investing as well. If you are close to retirement, and have a big enough financial nut in place to provide you with the desired income during retirement, there is no need to take unnecessary risks such as investing 50% of your assets into Bitcoin.

Conversely, if you are coming into retirement, and are falling woefully short of your desired income level then you might have to think of different ways to make up the shortfall. Some of the ways might involve more risk taking in your portfolio.

Lesson #7: Draw On Your Experience And Use It As A Guide

Tiger thought back to when he was on top and used that as experience to guide him to victory in this year’s Masters. He drew on his experience and used it as a guide. He has won before and can do it again.

I also try to draw upon my own investing experience and use it as a guide. I’ve lived through the 2001 dot come meltdown and the 2008 Great Recession. In both cases, there was a large market correction. I stuck to my guns, didn’t panic and didn’t sell out of stocks. I kept my approach of putting money into my retirement account buying the S&P 500 during these two periods.

If the talking heads in Wall Street are right, we are looking at an impending recession in the next 24 months with a sizable market correction. I will be sure to continue to draw on my past experience in going through a market down turn to guide me through the next one.

Lesson #8: Use Great Tools and Equipment

Tiger used equipment customized for him and, in some cases; he provided input into the design of his equipment. Using the right tools is important in obtaining success for him on the golf course.

I also try to use the right tools for my investing process. I use different online brokerage firms. They were selected because they can provide me with good market research, great transaction costs or low margin interest. I also use Mint and excel in tracking my expenses and finances. In order for me to win the investing game, I also need to rely on great tools and equipment.

Lesson #9: Seek The Help And Guidance Of Professionals

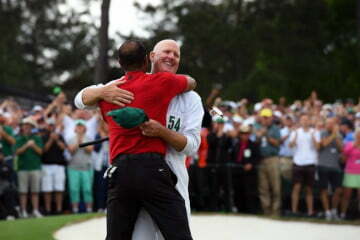

Tiger had a team in his corner when he won the Masters. His team included a swing coach, a trainer and his caddy.

It was helpful for me to also be able to seek help and guidance from investment professionals. I’ve spoken to people in finance and wealth management to better understand some of the investment processes they use, to better understand different investment products and to better understand fees and the financing options available.

Seeking the help and guidance of professionals has helped to enhance my investment returns.

To the audience: What did you think of Tiger’s win at the 2019 Masters? Are there any other lessons from this Tournament which can be applied to investing? What is the number 1 investing lesson you want to offer to the readers?

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Rich, I enjoyed this post! Once again, sports teach us valuable lessons that translate to all facets of life. Keep up the good work.

Thank you for the positive feedback. I think there are a lot of lessons that we can learn in the world of sports which can apply to personal finance and business as well. That is why I named the site Sport of Money.

Great post, Rich. The only time I watch golf is generally the last day of one of the 4 majors. Wow, that was fun watching Tiger win again!

Points #3 and #7 are my favorites.

#3: Without a doubt (for me), Tiger lost focus, and that was his (temporary downfall). He did not maintain his “eye of the tiger” (pun intended). It’s nearly impossible to win at high levels when your life is in chaos.

#7: I’m not sure the younger Tiger would have played that last hole so gently. The younger Tiger would have wanted to prove a point (of winning by multiple strokes). I loved watching him play that last hole. Don’t take chances when you’ve already won. Winning is all the proof you need (of how good you are).

#7: Interesting thought on what a younger Tiger would have done if he was put into that situation 15 years younger. You might be right about that – he probably would have had a feeling of overconfidence and invincibility to try to win by multiple strokes. I think people tend to be more cautious and wiser with age.