Charles Schwab conducted a 2019 modern wealth survey. With 1,000 American participants, Schwab asked a variety of questions pertaining to spending habits, planning, and wealth. According to the survey, Americans believe it takes an average of $2.3 million in personal net worth to be considered wealthy.

The average income of the survey participants is slightly over $65,000. It seems on average, they believe that it takes more about 35 times the income to be considered wealthy.

With a $2.3 million net worth, you will only need a 2.8% return a year to generate an income of $65,000. The 30 year treasury is currently yielding at that rate. Having that net worth can produce the average income of $65,000 with little to no risk.

With that net worth, the survey participants can be financially independent. I’m not saying that is what the survey participants had in mind or how the survey participants derived what it takes to be wealthy. But it’s interesting to see that they consider a wealthy net worth amount to be one that can provide them with enough of a passive income stream to replace their current income.

They can choose to quit their jobs and live off the $2.3 million in net worth.

Where $2.3 Million Really Stack Up In The Wealth Spectrum

First off, $2.3 million is a heck lot of money on a global basis (or on any basis for that matter). The global top 1% has a net worth of $770,000 according to Global Rich List. Having a net worth of $2.3 million puts you in the global top 0.21%.

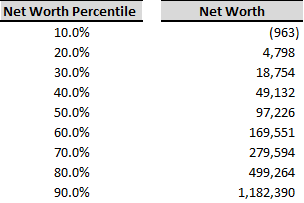

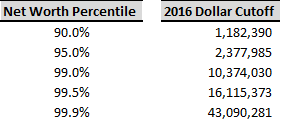

Of course, we are very blessed in America. It takes a lot more to crack the top 1% in the US. $770,000 won’t even get into the top 10% of United States net worth. According to dqydj.com, the net worth breakdown by percentile in America is as follows:

In order to be in the top 10% of net worth in America you will need slightly under $1.2 million. Dqydj.com also published a table further breaking out the top 10% of net worth in America. Interestingly enough, $2.3 million places you in the top 95% of US household net worth. Only 5% of the household in the United States of America has a greater net worth. Needless to say, $2.3 million does appear to be wealthy in America when compared to the rest of the population.

Is $2.3 Million Really A Lot?

I say it depends on the person/household. For this couple making a $1,000,000 a year living in the very expensive New York City, $2.3 million will not be able to provide them with financial freedom. That amount might still be able to put their mind at ease in the case of an emergency or a layoff.

I remember a bit over a decade ago, I had a conversation with one of my co-workers. We were working for a financial services firm at the time. We were making decent money compared to the median salary in America of $62,000. We made multiples of that amount at the time.

My colleague was in his early 30s at the time. As with any job, there are ebbs and flows. Sometimes he enjoyed the job and sometimes he couldn’t wait to get out. We were sitting around a lunch table one day shooting the breeze when he made the comment that if he had a million dollars right now, he would take it easy and become a bartender serving customers at a beach bar.

It surprised me to hear him say that. It wasn’t surprising that he wanted to be a bartender as he enjoyed drinking beer. It also wasn’t surprising to hear him want to work at the beach since who doesn’t like sun and sand. What I thought was surprising is the low number he cited of $1 million. I thought to myself at the time, given your high income and already close to a decade of work, shouldn’t you be close to $1 million in net worth.

The tone in which he made the statement made it seemed that he was far from that magically million dollar number. So to my former colleague, a million dollars can be the difference between grinding it out at a job he doesn’t particularly enjoy doing or working a dream job of hanging at the beach all day, making drinks and conversations with people.

So yes $2.3 million is a lot to my former dreaming-of-being- a-beach-bartender-one-day colleague.

$2.3 million is also a lot when compared to the medium net worth of the average American household of $97,300). It is over 20 times as great. The median size of an American house is 2,400 square feet. Now imagine a house at 48,000 square foot, 20 times as large as the median. I think we can all agree that is a gigantic house. Therefore, a 20 times higher net worth is wealthy indeed.

How Different Salaries Can Get To $2.3 Million

Now is $2.3 million an unachievable goal for the average American? Of course not! It will only be unachievable if you believe it is. With a disciplined approach, I believe most people can reach and surpass this number.

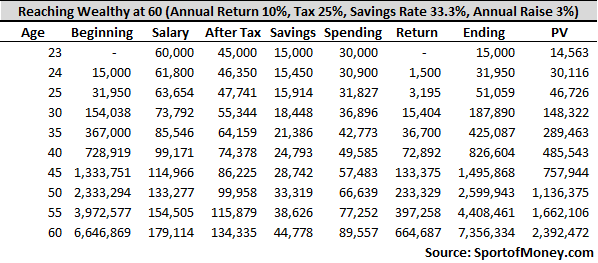

Single Earner College Graduate

Take the salary of a 23 year old college graduate starting out with $60,000 a year out of college named John. If John can save and invest 1/3 of his after tax salary on an annual basis and achieve an annual 10% return a year (historical return of the S&P 500), he can get to be wealthy before the age of 50. This assumes a 3% annual raise and a 25% tax rate. See the table below.

Now if you want to inflation adjust the numbers, then assuming inflation is 3% (the same rate as his salary increases), John can reach the wealthy level by age 60.

Despite saving 1/3 of his after tax savings, John is able to still spend 2/3 starting with $30,000 a year at the age of 23.

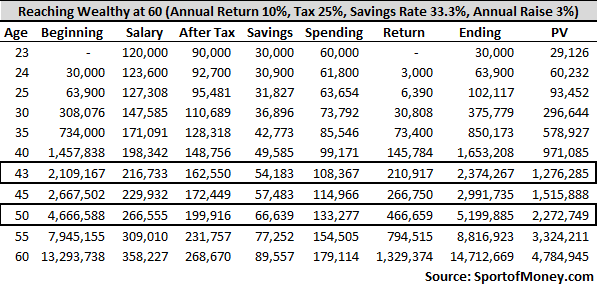

Dual Earning College Graduates

Now if John meets Jane, also a 23 year old college graduate with a starting salary of $60,000 and they both end up getting married at the age of 25, you can see how quickly both of them combined can get to the $2.3 million wealth mark.

Jane and John as a couple can achieve wealthy status by the age of 43 not adjusted for inflation. If adjusting for inflation of 3%, they will amass a net worth of $5 million (present value of $2.3 million) by the age of 50 and will be considered wealthy according to the survey.

In the meantime, they can spend $60,000 cash post tax the first year out of college on a combined basis and that amount moves up from there. That isn’t a bad amount of spending on an annual basis.

Let’s take a look at how quickly folks in different professions can reach the wealthy status. The examples below assume a 10% return on investments (similar to the historical return for the S&P 500), a 3% annual rate of inflation and a savings rate of one-third of after tax pay (two-thirds of after tax pay for spending).

Big 4 Accountant

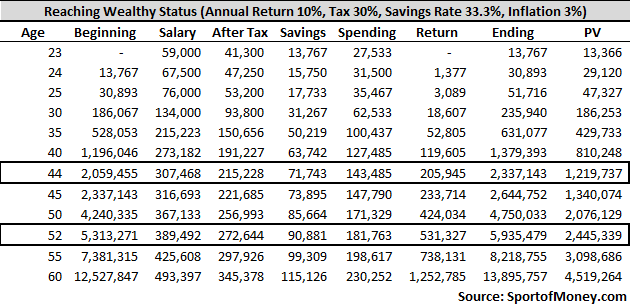

A typical Big 4 accountant can reach wealthy status by age 44 on an unadjusted basis and at 52 on an inflation adjusted basis (3% inflation).

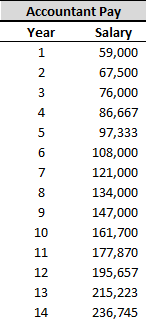

A Big 4 auditor starts at a salary of $59,000 and can expect to receive salary increases ranging from 10 to 15% over the next 13 years.

Traditionally, the promotion path is associate, senior associate, manager, senior manager and then partner. In the table below, I assumed the best this auditor can do is get to the senior manager level and then plateaus without making it to partner.

The table below also doesn’t factor in year-end bonuses which can range from $0 to $25,000 at the senior manager level.

My last assumption is that the senior manager, after the age of 37, only gets a 3% raise going forward.

Big Law Lawyer

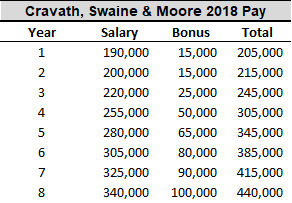

Cravath, Swaine & Moore is one of the most prestigious law firms out there. Many might even argue that it is the number 1 law firm. Not surprisingly, the salary and bonus of their associates match their reputation for hiring the best of the lot from law school.

See below for 2018 total pay for the associates of the firm.

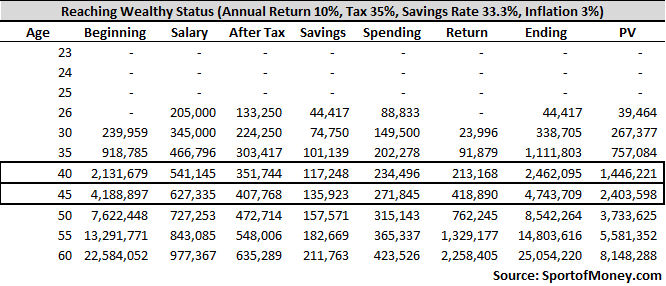

Since lawyers have to attend law school for 3 years after undergraduate college, this lawyer at Cravath, Swaine & Moore doesn’t start work until the age of 26. From there, the lawyer earns the compensation of the table above, topping out after 8 years with then a 3% annual raise.

This assumes the lawyer doesn’t make the leap to partner.

The lawyer ends up achieving about a $2.5 million net worth at the age of 40 not adjusting for inflation. On a present value basis in hitting $2.3 million, the lawyer can achieve it at the age of 45.

The lawyer should still be able to enjoy a high consumption lifestyle even after saving one-third of pay.

Investment Banker

Investment bankers can definitely make good money. But after 2 or 3 years as an analyst, it becomes hard to advance as an associate without an MBA. Therefore, after 3 years of working, and in order to continue to climb the investment banking ladder, you have to put your career on hold for 2 years pursuing an MBA.

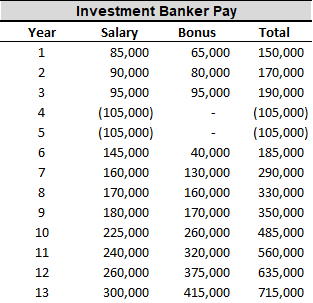

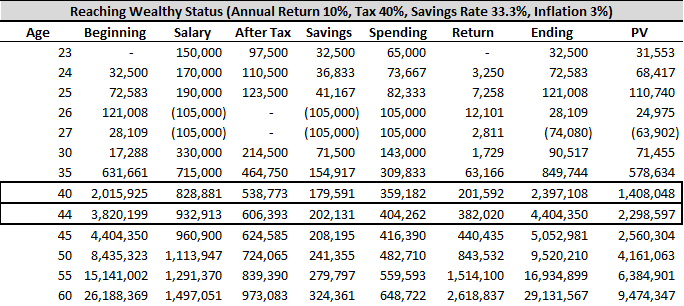

See below for an example of an investment banker’s pay for the first 13 years. A Harvard MBA costs $105,000 a year. I’ve factored that in for this investment banker for years 4 and 5. I’ve also assumed the investment banker plateaus at the Director level and cannot make the jump to Managing Director.

Not surprisingly, with such high pay, the investment banker can spend at a high level as well, even after factoring in a 40% tax rate and a one-third savings rate.

The investment banker will reach wealthy status by the age of 40 on an unadjusted basis and at 44 when adjusted for inflation. Obviously, the 2 years away from work and off paying for an MBA did not help.

You can see how the net worth can continue to climb after 45 given the return on the accumulated financial nut as well as the continual savings.

Optimism About The Future

As illustrated above, people in different professions can hit the wealthy status of achieving $2.3 million in net worth. Of course, higher income earners have an easy path to get there. This shouldn’t surprise anyone. But a single earner starting off with $60,000 can still get there by the age of 60.

Therefore, this net worth of $2.3 million is very achievable. In my mind, this is also reinforced by the optimism shown by the survey participants.

60% responded they are optimistic that they are already wealthy or will be wealthy someday. More than 50% think they can achieve being wealthy within 10 years.

Those are high numbers. Many survey participants are very optimistic about their future. It doesn’t take much to get there – just continue to earn money, save a significant portion (greater than 30%) and invest that money.

To the audience: Do you agree $2.3 million is considered wealthy? If not, what is the amount in your mind? What is your net worth and do you consider yourself to be wealthy? If you are not wealthy, when do you see yourself hitting that net worth if ever?

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

Once again, the math shows most everyone should be “winning”.

As for whether 2.3M is wealthy… I guess based on standards and comparing what others have, the answer is yes. If you look at a relatively conservative 3%-4% withdrawal rate (60-90K/year), it’s just OK (if you plan on not working). If you’re still working, and your bills are paid by your work, that money can continue doubling every 7-10 years. 20 years and you no longer have 2.3, you have 15-20M!

Personally I see around 5M to be wealthy. When you can freely spend 150-200K/year, that’s a good bit more than many could spend. Remember, you don’t have to save any of this 3%-4% withdrawal. And if your house is paid for, too, well… let’s just say life is easy.

Great charts though… especially laying out spending of two young marrieds making ~60K each. That’s basically the scenario I’ve tried to teach my son. He’s 28, but not married yet.

$150 to $200k income per year from $5 million – definitely can afford a great lifestyle, especially given it is 3 times the median American household income.

That global rich list link is pretty cool, really put things in perspective! I would consider 2.3 million wealthy as it compares to my current standard of living, but certainly could find more things to spend money on! Take care!

Just curious to see what you would want to spend the money on if you have excess above and beyond what you need to maintain your standard of living in perpetuity?

I used to think anyone in the US could become wealthy too if they just work hard and get a little lucky, but more and more I’m starting to question that idea.

Do you mind sharing why you are questioning that idea? What changed your mind about anyone can be wealthy in the US through hard work?

How did you manage to achieve several times the average wealth in your 30s?

A few things but most of them are tried-and-true:

(1) Earn as much as possible as quickly as possible. While my first job wasn’t very high paying as a college graduate, I made a few jumps along my professional career which helped boost my income.

(2) Save as much as possible. I saved starting on work day number 1. I never stopped saving.

(3) Invest. I didn’t just save my money and let it depreciate in value, I invested my money. There was a set back in 2008 but I kept at it. Fortunately, the past decade of asset growth fueled a nice increase in net worth.

It’s math. I started early on my wealth building process (earn, save and invest) and now it is really snowballing. For instance, a 10% return on $10,000 gives you $1,000, but a 10% return on $10,000,000 gives you $1,000,000. It really pays to have built my financial nut up sooner rather than later.