Hanging around the personal finance blogosphere enough, and you are most certainly going to run into the FIRE (Financial Independence, Retire Early) crowd. Indeed, FIRE is a very hot topic for many.

Looking back to when I first started my professional career out of college, I was a big fan of FIRE too. But at the time I wasn’t aware of this fancy acronym. One of my first personal finance goals was to have enough money to not have to work at the earliest age possible.

I used to think to myself I work now to not have to work later. And I hoped later would come very soon.

There are some successful FIRERs (is that the right word to describe someone pursuing FIRE?) out there who were able to cut their corporate job cord and were able to reclaim freedom of their time again. Some of those successes are people in their late 20s to early 30s.

Now I know the FIRE movement is very attractive, especially to the younger crowd. Who wants to be stuck at a cubical working 10 hours days in an unsatisfying job with a company which is more loyal to its bottom line than its employees?

It is certainly not me. So I understand the feeling of wanting to achieve FIRE at the earliest age possible and walking away from the “machine” built by someone else. Heck, as mentioned, I had the same thought right out of college even before I knew what FIRE is.

But I’m here to also say, while it is great to FIRE, there is also an optimal time to FIRE and a sub-optimal time to FIRE.

In my mind, a lot of the people who FIRE in their 20s and early 30s have made a mistake of living the FIRE lifestyle too early.

Be smart about this. Don’t FIRE too early.

Why FIRE At The Age of 20s And Early 30s Is Too Early

First off, if you follow the “typical” path of a college graduate in the United States of America, you graduate college at the age of 22 or 23. Let’s see why looking to FIRE in 8 to 12 years is not the right approach.

No Clue What You Want At Such A Young Age

Let’s face it, there are not many of us who are sure of what we want regardless of our age. But surely, we were even more uncertain as to what we really want in our 20s.

If you don’t know what you want, how can you say with certainty that FIRE is the right move for you?

Maybe it sounds good, being able to walk away from being a corporate drone, not having to deal with bad bosses, office politics and the daily commutes to the office. But who is to say that the grass is greener on the other side?

Maybe you want to spend the next 2 years traveling after quitting and dancing your way out the door. That’s fine for 2 years, then what next?

What will you do if you Retire Early and walk away from it all? Will you even be more lost and confused with what to do with your life?

Working grounds you. It gives you order in your life. Some people even find meaning in the work they do. At such a young age (in your 20s to early 30s), do you really have a clue as to what you want out of life and what you want to do with the free time after Retiring Early?

Lifestyle Is Not Set

FIRE, as previously mentioned, is made up of two parts. FI = Financial Independence and RE = Retire Early.

The financial independence part is tough to nail down in your 20s and 30s. That is because your lifestyle is not set at that age. I know my lifestyle most certainly was not.

What I envisioned to be a good lifestyle in my early 20s has changed when compared to how I live today. I can bet that you, too, will experience a change in lifestyle from your early 20s.

I was not married at the time. Now I am married with 3 kids. My life and lifestyle changed over the past 20 years.

You might be single now living a Spartan lifestyle to achieve financial independence. But your FI number is calculated based off of your current lifestyle.

What happens if your lifestyle changes? What if you want or need to live in a more expensive city? What happens if you want to settle down and buy a house? What happens if you want to expand your current family with kids?

Those changes can result in a more expensive lifestyle down the line. What you have calculated to be your FI number was off of your old lifestyle.

You are no longer financially independent after the change in lifestyle. I would imagine it is probably a lot harder to have to work for money after being FIRE for a period of time.

Your lifestyle is just not set in your 20s and early 30s. Without a set lifestyle, you don’t really have a basis of what to base your FI number.

Lost Opportunity For Professional Development

When I first started out in my professional career, I spent a lot of time doing less than glamorous work. There were hours, maybe days, spent making photocopies in front of a printer and punching binder holes on sheets of paper.

Maybe you were asked to get coffee, make photocopies, format an excel file or word document, or change the color on a power point presentation. We have all been there and done that. It is called “paying your dues”.

Once your dues have been paid the first few years, you get to pass some of the less than glamorous work down to the new hires and you move on to something bigger and better.

Hopefully, you can continue to learn and grow professionally year after year.

Retiring early, especially at 8 to 12 years in, can prevent you from continuing on the professional growth path. You might experience a lost opportunity for professional development and growth.

Sure, the first couple of years might be tough. But as you progress along your professional career, things should get more and more interesting.

After 8 to 12 years, you might be able to work yourself into being a team leader where you can work on your leadership, communication and presentation skills.

Maybe you get to be the lead on a client relationship or have the ability to make key decisions on behalf of your company.

You will lose opportunities to continue to grow, especially in the later years when you can pick up a set of new responsibilities, which can further enhance your professional (and maybe personal as well) development.

You also don’t know how you might like the job after increasing your responsibilities. Maybe you hate making photocopies today, but you might enjoy leading a sales pitch to a perspective $3 million a year client. Why retire early and miss out on that part of your experience?

Leaving Before Hitting Your Peak Earning Years At Work

Similar to leaving before hitting a high point in your professional growth, you are also leaving before hitting your peak earning potential at work.

By the 8th year, you have endured going through the “hazing” phase of your job, and are now starting to get more responsibilities and hitting your stride.

Your paycheck should follow suit. You were getting paid peanuts younger to do less than glamorous work. Now you are in your late 20s or early 30s, doing a bit of glamorous work and getting paid accordingly.

Why leave before you get to do the very glamorous work and get paid handsomely to perform. Retiring in your late 20s or early 30s leave so much money on the table.

You don’t want to leave your employer before you hit your peak earning years at work. Think about it this way: You were paid little to do a torturous job. Why leave just when you can start to reap the reward for having gone through those early years.

Not Enough Time For Your Financial Nut To Grow

If you are keen with personal finance or have been following this blog, you know compound interest is the most powerful force in the investment universe.

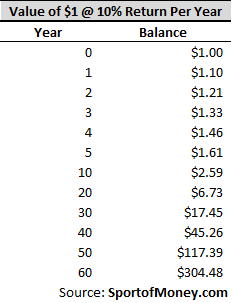

A simple table below illustrates the power of compound return.

At an annual return of 10%, the $1 grows to $1.10 at the end of year 1. By the end of year 5, the $1 grows to $1.61. You can see the number getting exponentially bigger as more years pass. By year 60, that same $1 has grown to over $300.

Wow, isn’t compounding amazing!

Therefore, the longer the time horizon, the better your financial nut can provide for you.

When you start to dip into your savings to support an early retirement after you have walked away from your job, you don’t allow that $1 the ability to grow into something more. The income generated will be used to support a FIRE lifestyle, and cannot be reinvested.

This prevents the power of compounding to take hold.

If you retire in your late 20s or early 30s, there is definitely no time for your financial nut to experience the great power of compounding. That would be such a shame.

More Retirement Tail Risk

This is should hopefully be intuitive. The longer the retirement period, the longer the tail risk you can experience.

There is just a greater risk of you running out of money given the longer time you spend in retirement.

After retiring in your early 30s, you can be facing a retirement period of 70 years. A lot of things can happen during that time frame.

The market might have a correction. There might be an emergency situation in which you need money. Maybe Apple runs into financial trouble and that triple AAA rated bond you were banking on to provide you with a steady cash flow stream is now in doubt.

That is just too long of a time to have to plan for and navigate without a steady income during the period.

Now, hopefully, you see why walking away in your 20s and early 30s is too early to live your retirement dream.

The Best Time To Retire Early

I think a better time to retire early is in your late 40s to 50. Basically, for those super early retirees, move the timing back 2 decades.

By retiring at the age of late 40s to 50, you get to enjoy the benefits of early retirement while addressing some of the downside of retiring way too early.

One of the biggest complains I come across regarding retiring at the normal retirement age in the mid-60s is that there is a lack of energy to travel and do stuff. But retiring in your late 40s to 50, you should still be in good physical shape and have enough energy to travel and be active.

If you want to pivot and start another career or tackle another venture, there is still enough time for you to pursue the new endeavor. You still have 1.5 to 2 decades to achieve your new professional goals which would place you at the age of 65, the “normal” retirement age.

If you want to totally disconnect from working another professional job again, there are still plenty of years ahead for you to enjoy life.

It also seems like a good balance between work and play to retire at around the age of 50. It provides about 30 years of professional work and, hopefully, over 30 years in retirement. It is still FIRE, but at a more reasonable, logical and optimal age and time in your life.

Cons Listed Above To Early Retirement (In 20s and 30s) Are No Longer Applicable In Your Late 40s to 50

The cons I’ve listed for retiring too early are no longer valid or have been mitigated when retiring in your late 40s to the age of 50.

Con:

No Clue What You Want At Such A Young Age In Your Late 20s/Early 30s

Why it doesn’t apply or gets mitigated at your 40s/50:

At the older age, you should have a better sense of what you want and enjoy. You are more aware of yourself, your priorities and hobbies. You should be able to better utilize your free time in pursuing what you value after retiring in your 50s versus in your 30s.

Con:

Lifestyle Is Not Set In Your Late 20s/Early 30s

Why it doesn’t apply or gets mitigated at your 40s/50:

There are many life changes that can happen to you in your 20s and 30s. Your lifestyle should be more set in your late 30s. Therefore, you have a better understanding of how much sustaining that lifestyle costs and can plan/save accordingly.

Con:

Retiring Too Early Results In A Loss Opportunity For Professional Development

Why it doesn’t apply or gets mitigated at your 40s/50:

Extend your professional career by another 20 years and you get to experience more professional growth and development. You won’t just leave the workforce after spending a good chunk of your years doing grunt work.

Con:

Leaving Before Hitting Your Peak Earning Years At Work Happens In Your Late 20s/Early 30s

Why it doesn’t apply or gets mitigated at your 40s/50:

Staying for another 20 more years ensures you can take advantage of your higher earning years. Just as you provide for more time for your professional skills and responsibilities to develop, your compensation should increase commensurately as well.

Con:

Not Enough Time For Your Financial Nut To Grow If Retiring Too Early

Why it doesn’t apply or gets mitigated at your 40s/50:

Having another 20 years of income can provide more time for your financial nut to grow and allow the power of compounding to work its magic.

Con:

Retiring Too Early Results In More Retirement Tail Risk

Why it doesn’t apply or gets mitigated at your 40s/50:

The tail risk is reduced by cutting down your retirement by 20 years. Not only do you allow your financial savings to grow, you have fewer years that you need that savings to cover.

To the audience: Are there any other risks or downside I didn’t cover when retiring too early? What are some more benefits to waiting until your late 40s to 50 to retire early? What do you think is the optimal age to FIRE?

Related Posts

Easy Math Trick To Crush Retirement Goals And Why People Have The Wrong View About It

Don’t Fire, Join The Work LITE Movement Instead

7 Secrets From Two 401(k) Millionaires To Turbocharge Your 401(k)

Many people work hard to better their physical and mental health. What about their financial health?

I started this blog back in 2019 to help people better their financial health as well.

My financial journey began with tens of thousands in student loan debt. Over the span of 20 years, I am close to achieving financial independence.

I truly believe anyone can get to strong financial health. Hopefully, this blog can help you on your financial journey to greater wealth and financial independence.

You can read more about me here.

Thank you for visiting. Come again soon!

That’s a pretty complete checklist, Rich. I know people are all over the board when it comes to maturity level, but I’m almost 52 now. I am a very different person than I was at 32. And I have always been a pretty responsible person. You do (or should) gain wisdom with age. I know I have. A key point of your post is you simply don’t know what you don’t know in your 20’s and 30’s. It’s very true. And I fully understand when I’m 72, I’ll be surprised at what I didn’t know at 52.

And money-wise, when I was in my 30’s, I thought a million dollars was a lot of money. It is if you’re still letting it compound, but it’s not if you’re planning on living the rest of your life on it. Heck, if you’re 65 and drawing social security, a million dollars isn’t too bad, because social security is like having another million. But these LeanFire folk who retire with 1M or less in their 30’s… that’s a bit much. *If* they are actually retiring… it’s totally fine if they’re simply going to work something else or a side hustle in addition to that.

Right, if you have to continue to work to survive, then are you really FIRE. I can understand there are certain folks who have achieved FIRE and choose to do work they simply enjoy or tackle a side hustle. But I would say that it is more an option than a need. Once you need to work to survive, then that isn’t a good model for an early retirement.

After several of your insightful comments on my blog I had to come over and visit your blog (sorry it took this long but I have such a long list of blogs I follow it is hard to put another one in the line up). Anyway I am glad I did.

This post hits the nail on the head. I too think retiring in your 20s is a very risky move. Even if you are financially independent at this moment does not mean you will be later. Problem is when you realize that mistake it may be too late as your human capital has diminished and it may not be as easy or as lucrative to join the workforce.

As a physician retiring on the 20s can’t be done. Some try it on their mid 30s just a few years out of residency. That too is a bit of a gamble. I have been shooting for age 53 as my FIRE date at the latest. I’m 48 now and know I am financially independent right now but I want several margins of safety before I pull the plug because once you leave medicine it is very hard to get back in it.

Plus I prefer having a fat FIRE type lifestyle in retirement. Those on lean FIRE trajectories don’t have much room for error

Thank you for the visit. I enjoy reading posts you have on your blog.

I can’t imagine attempting to lean FIRE as a physician. 8 years of investment in schooling and years more as a resident. If I went through all that, I will surely want to maximize my reward and shoot for fat FIRE.

This is really good. I think the biggest one here is the lifestyle. Young people think they can live cheaply forever, but only a few people can really do that. Once your lifestyle is set, then you’ll have a more realistic budget.

The key for us is to minimize early withdrawal. That’s the best guarantee. Leave the retirement fund alone and you’ll be set when you’re older. You just need to find part-time work that you can enjoy.

IMO, retiring around 40 is ideal if you can make it work. 50 is still really good.

Joe – you have been retired for a number of years at 40 and it is working for you. Good for people to listen to your sound advice “minimize early withdrawals”. That is why I like investing in real estate. It provides a cash flow stream without touching principal.