My quick takes on personal finance articles.

November 9, 2022

What the hell just happened in crypto? A Q&A in plain English about Binance’s takedown of FTX

Article Summary: The article walks through how one crypto billionaire took down another crypto billionaire. CZ, co-founder and CEO of Binance, took down SBF and FTX.

My quick take: Buyers beware in the crypto space. My gut feeling is most crypto companies are houses of cards. There are many self dealings and over levered companies in this space. Those companies only work when asset prices move up. With the big pull back in the crypto market this year, we are seeing who is swimming naked. I favor using a hard wallet to store your coins to avoid exposure to trading firms freezing withdrawals. Also, incredible to see how CZ played chess and took down a competitor.

November 6, 2022

Rolex Prices to Drop Further as Supply Surges: Morgan Stanley

Article Summary: An index of the most popular models of watches tracked by WatchCharts has fallen by 21% since the market peak in April. Secondhand watch dealers and individual watch investors are off-loading their stocks resulting in a significant increase in watch inventory. Prices for the most popular pre-owned Rolex, Patek Phillippe, and Audemars Piguets will fall further.

My quick take: I went through a watch phase years back. Although it was nice to track how much watches are going for on the secondary market, they were never investments for me. I went for high-demand watches that I enjoyed and I purchased retail (never paid a markup on the secondary market). Watch prices, especially for steel watches, went up so much in such a short period of time that I didn’t think they were sustainable over the long run. The pull back in pricing isn’t a surprise given how other asset classes have performed (stock and crypto). I believe watch prices will mirror stocks and cryptos in price performance but with a lag.

November 2, 2022

Fed again raises interest rates by 75 basis points, Powell to talk hike path

Article Summary: The Fed raised interest rates by 75 basis points for the 4th straight meeting while hinting at a potentially slower pace in the future. This rate hike brings the federal funds rate to a new range of 3.75% – 4%, its highest level since the end of 2007.

My quick take: The 75 basis point rate hike was expected by the market and priced into the numbers. The key is the Fed’s message about what they plan to do next. Hopefully, the rate hikes are having a positive impact in slowing down inflation without harming the economy too much. I think there are still more rate hikes to come, albeit at smaller rate increases.

November 1, 2022

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Article Summary: Individuals aged 21 to 42 with at least $3 million in assets only have 25% of their portfolio invested in stocks. Rich millennials favor cryptocurrency, real estate, and private equity.

My quick take: I like the alternative asset classes listed in the article. However, I still believe investing in the US stock market, namely the S&P 500 index, is the best way to go for an investment portfolio. I am a huge fan of real estate and believe it should be a part of any well-balanced portfolio. I’ve built up my real estate portfolio over the past 15 years and now that generates enough net cash flow to support my lifestyle. I also have crypto and private equity investments. I believe they are suitable for people who already have a robust liquid investment portfolio, don’t need the liquidity, and can stomach the risk.

October 25, 2022

Dave Ramsey Says Your Car Could Cost You $10 Million — and He May Be Right

Article Summary: Investing the average car loan of $577 per month with an annual return of 11% can lead to $10 million by age 67 when starting at age 21. That is how your car can cost you $10 million.

My quick take: Obviously, the $10 million number is meant to be headline grabbing. One will still need a car so saving the entire balance of $577 is not realistic. The take away is to limit your car expense because it is money out the door. As with any expenses, it is best to spend moderately so that you can invest the rest. Housing expense and car payments are the two big expenses to reduce.

October 22, 2022

401(k) Contribution Limits Are Taking a Big Jump for 2023

Article Summary: 401(k) contribution limits went up by close to 9% from $20,500 to $22,500 in 2023. The catchup amount for people ages 50 and older went up to $7,500 from $6,500. That means a 50 year old can contribute $30,000 in total to a 401(k) plan.

My quick take: Due to the high rate of inflation, the 401(k) contribution limit went up as well. This is good news for us looking to save for retirement. Let’s continue to contribute the maximum amount to take advantage of the tax benefit and to build a robust financial nest egg.

October 20, 2022

How to choose between a home equity loan and a personal loan when you’re in need of extra funds

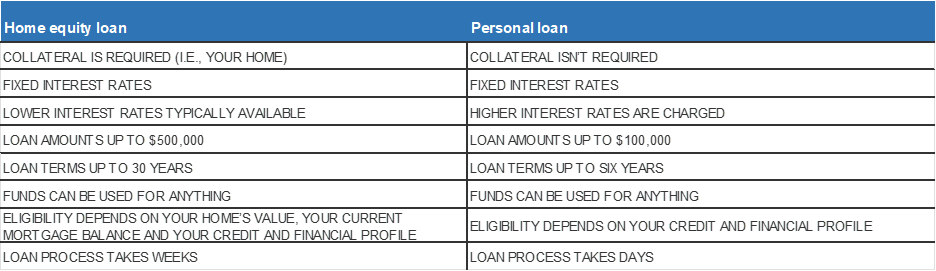

Article Summary: The below table from the article summarizes a home equity loan (HELOC) vs. a personal loan.

My quick take: It is nice to have liquidity, especially when the stock and crypto markets have come down significantly from their all time highs. There are many investment opportunities to take advantage of and having the funds to make investments during these depressed times can lead to very nice gains in the long run. I believe anyone financially comfortable should, at the minimum, have a HELOC. There are a number of banks offering an HELOC at no cost to the homeowner.

October 19, 2022

Here are the federal income tax rates and brackets for 2023

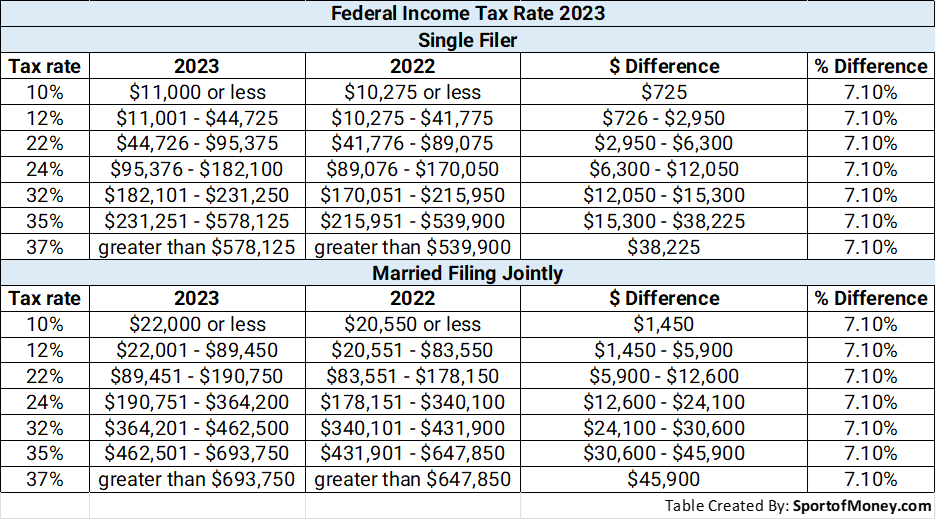

Article Summary: Income tax brackets and standard deductions have increased due to the high rate of inflation. The results should be less taxes paid for the same income as prior year.

My quick take: The income tax brackets went up by 7.1% across the board. Standard deduction went up by 6.5%. It is always good to see sensible adjustments to the income tax brackets and standard deduction. Less taxes means more money in our pockets – which is always a good thing in my book.

October 13, 2022

Here’s exactly how much Americans at every age have actually saved — and what they should be saving

Article Summary: Lists the average savings balance by age of Americans excluding retirement balance and provides financial advisor guidance of saving 20% of earnings.

My quick take: The average savings of Americans, regardless of age, is abysmal. You will never be able to retire early tracking to the average balance. Comparing to the average balance is meaningless for someone seriously wanting to reach financial freedom early.

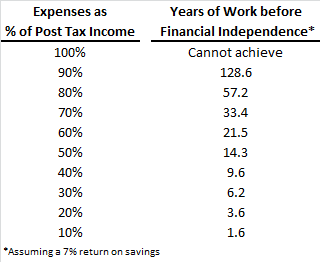

Also, the 20% savings rate will never lead to financial freedom. See the table below. Assuming a 7% return, it will take over 57 years to get to financial independence. To achieve financial freedom at a decent age, shoot for a 40% savings rate. That way, you can get to the finish line in under 22 years.

October 12, 2022

What Dimon’s ‘Easy 20%’ Drop in the S&P 500 From Here Looks Like

Article Summary:The CEO of JPM Morgan thinks the stock market can drop another 20% from here. Excerpt from the article: “The S&P 500 is already down 25% from it’s Jan. 3 closing high. Another 20% decline from its high would push it about 40% below its peak — far beyond the average drawdown for bear markets. Since World War II, there have been nine bear markets that have been accompanied with a US recession, with the S&P 500 declining 35% on average versus a 28% decline in bear markets that didn’t come with an economic downturn, according to CFRA.

My quick take: I also don’t believe we are at the low for the stock market. Timing the market bottom is impossible. The way things stand today, I do plan to start deploying my capital more aggressively with another 10% drop in the stock market. The market is expecting a terminal value for the Fed Funds rate of 4.7%. With another anticipated 75 basis point increase in the next FOMC meeting, that gets the Fed Funds rate to 4%. Hopefully, by then the market will feel the end of interest rate increases is near and will be more optimistic with the future.

October 11, 2022

Average Retirement Age in Every State

Article Summary: Lists for all 50 states the average retirement age, annual cost of a comfortable retirement, and the retirement savings needed.

My quick take: Positively surprised to see the average retirement age ranges from early-60s to mid-60s. The comfortable retirement cost appears to hover around the average income for the states. The retirement savings needed for a comfortable retirement generally fall between $800,000 to $1.2 million for most states. That is a very achievable amount, especially if people start saving in their mid-20s to early 30s.